Tax Treatment Of Sale Of Book Of Business . Web when you sell your business you may face a significant tax bill. Web the sale of a business usually is not a sale of one asset. The most common deal structure when buying or selling a financial services. In fact, if you're not careful, you can wind up with. Instead, all the assets of the business are sold. Web check if specific business expenses (starting with g to l) are deductible, e.g. While there are significant differences in the tax implications of an. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account.

from www.sampleforms.com

Web when you sell your business you may face a significant tax bill. While there are significant differences in the tax implications of an. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web the sale of a business usually is not a sale of one asset. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Instead, all the assets of the business are sold. The most common deal structure when buying or selling a financial services. Web check if specific business expenses (starting with g to l) are deductible, e.g. In fact, if you're not careful, you can wind up with.

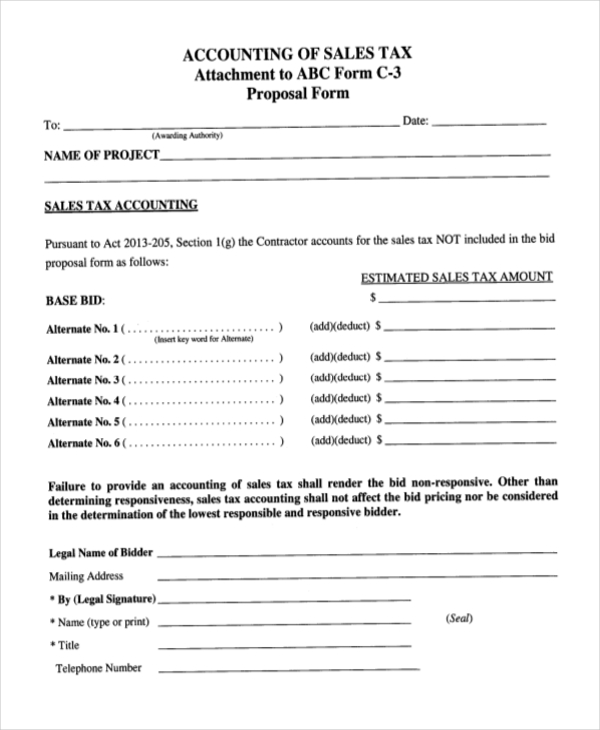

FREE 8+ Sample Blank Accounting Forms in PDF MS Excel MS Word

Tax Treatment Of Sale Of Book Of Business Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. The most common deal structure when buying or selling a financial services. Web the sale of a business usually is not a sale of one asset. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. While there are significant differences in the tax implications of an. Web when you sell your business you may face a significant tax bill. Instead, all the assets of the business are sold. Web check if specific business expenses (starting with g to l) are deductible, e.g. In fact, if you're not careful, you can wind up with.

From secfi.com

Incentive stock options (ISOs) and taxes the complete guide — Secfi Tax Treatment Of Sale Of Book Of Business Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. While there are significant differences in the tax implications of an. Instead, all the assets of the business are sold. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you. Tax Treatment Of Sale Of Book Of Business.

From www.morebooks.de

Accounting and Tax Treatment of the Fixed Assets, 9783659490866 Tax Treatment Of Sale Of Book Of Business Web when you sell your business you may face a significant tax bill. Web the sale of a business usually is not a sale of one asset. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web a transfer of ownership of a singapore business. Tax Treatment Of Sale Of Book Of Business.

From studylib.net

Specific small business tax treatments Tax Treatment Of Sale Of Book Of Business Web check if specific business expenses (starting with g to l) are deductible, e.g. In fact, if you're not careful, you can wind up with. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Instead, all the assets of the business are sold. While there are significant differences in. Tax Treatment Of Sale Of Book Of Business.

From www.slideserve.com

PPT CHAPTER 3 Financial Statements, Cash Flow, and Taxes PowerPoint Tax Treatment Of Sale Of Book Of Business Web the sale of a business usually is not a sale of one asset. In fact, if you're not careful, you can wind up with. Web when you sell your business you may face a significant tax bill. Web check if specific business expenses (starting with g to l) are deductible, e.g. While there are significant differences in the tax. Tax Treatment Of Sale Of Book Of Business.

From www.slideserve.com

PPT Tax Effect Accounting (AASB 1020) PowerPoint Presentation, free Tax Treatment Of Sale Of Book Of Business In fact, if you're not careful, you can wind up with. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web when you sell your. Tax Treatment Of Sale Of Book Of Business.

From www.fidelity.com

Asset location Investing in the right accounts Fidelity Tax Treatment Of Sale Of Book Of Business Web when you sell your business you may face a significant tax bill. Web the sale of a business usually is not a sale of one asset. In fact, if you're not careful, you can wind up with. While there are significant differences in the tax implications of an. The most common deal structure when buying or selling a financial. Tax Treatment Of Sale Of Book Of Business.

From studylib.net

Treatment of Withholding Tax Tax Treatment Of Sale Of Book Of Business Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web when you sell your business you may face a significant tax bill. Web the sale of a business usually is not a sale of one asset. Web check if specific business expenses (starting with g. Tax Treatment Of Sale Of Book Of Business.

From kindnessfp.com

How to Choose Beneficiaries with Taxes in Mind Kindness Financial Tax Treatment Of Sale Of Book Of Business Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. While there are significant differences in the tax implications of an. Web check if specific business expenses (starting with g to l) are deductible, e.g. Instead, all the assets of the business are sold. Web when you sell your asset. Tax Treatment Of Sale Of Book Of Business.

From www.pinterest.com

A Comprehensive Guide to Tax Treatments of Roth IRA Distributions Tax Treatment Of Sale Of Book Of Business While there are significant differences in the tax implications of an. Web the sale of a business usually is not a sale of one asset. In fact, if you're not careful, you can wind up with. Web check if specific business expenses (starting with g to l) are deductible, e.g. Instead, all the assets of the business are sold. Web. Tax Treatment Of Sale Of Book Of Business.

From animalia-life.club

Royalty Trust Tax Treatment Tax Treatment Of Sale Of Book Of Business In fact, if you're not careful, you can wind up with. The most common deal structure when buying or selling a financial services. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web when you sell your business you may face a significant tax bill.. Tax Treatment Of Sale Of Book Of Business.

From event.webinarjam.com

(FREE) Tax Treatment of Financing Costs Tax Treatment Of Sale Of Book Of Business Web the sale of a business usually is not a sale of one asset. In fact, if you're not careful, you can wind up with. Web when you sell your business you may face a significant tax bill. The most common deal structure when buying or selling a financial services. Web when you sell your asset (including disposal or transfer. Tax Treatment Of Sale Of Book Of Business.

From www.banwo-ighodalo.com

Tax Treatment Of NonProfit Entities In Nigeria Grey Matter // Banwo Tax Treatment Of Sale Of Book Of Business Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. In fact, if you're not careful, you can wind up with. Web the sale of a business usually is not a sale of one asset. Web check if specific business expenses (starting with g to l). Tax Treatment Of Sale Of Book Of Business.

From www.sampleforms.com

FREE 8+ Sample Blank Accounting Forms in PDF MS Excel MS Word Tax Treatment Of Sale Of Book Of Business While there are significant differences in the tax implications of an. In fact, if you're not careful, you can wind up with. Web when you sell your business you may face a significant tax bill. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web. Tax Treatment Of Sale Of Book Of Business.

From www.slideserve.com

PPT Basic Principles of Taxation of US Corporations PowerPoint Tax Treatment Of Sale Of Book Of Business In fact, if you're not careful, you can wind up with. Web the sale of a business usually is not a sale of one asset. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. The most common deal structure when buying or selling a financial services. Web when you. Tax Treatment Of Sale Of Book Of Business.

From desklib.com

Taxation Treatment of Capital Gains/Losses on Sale of Assets Desklib Tax Treatment Of Sale Of Book Of Business Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. The most common deal structure when buying or selling a financial services. Web check if specific business expenses (starting with g to l) are deductible, e.g. In fact, if you're not careful, you can wind up with. Instead, all the. Tax Treatment Of Sale Of Book Of Business.

From www.zoho.com

VAT Items Help Zoho Books Tax Treatment Of Sale Of Book Of Business Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. While there are significant differences in the tax implications of an. The most common deal structure. Tax Treatment Of Sale Of Book Of Business.

From law.asia

Tax treatment of foreign companies clarified India Business Law Journal Tax Treatment Of Sale Of Book Of Business In fact, if you're not careful, you can wind up with. Web a transfer of ownership of a singapore business can take the form of a disposal of stock or assets. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. While there are significant differences. Tax Treatment Of Sale Of Book Of Business.

From www.moneyweb.co.za

Be aware of correct tax treatment of severance benefits Moneyweb Tax Treatment Of Sale Of Book Of Business Web check if specific business expenses (starting with g to l) are deductible, e.g. The most common deal structure when buying or selling a financial services. Web when you sell your asset (including disposal or transfer of the asset to another party for a consideration), you are required to account. Web the sale of a business usually is not a. Tax Treatment Of Sale Of Book Of Business.